Babylon: Trustless Bitcoin Yield for the Masses – Learn how Babylon works!

Many Bitcoin holders want yield – for their BTC to generate passive cashflow. But, due to its limited capabilities, native yield has always been impossible on the Bitcoin blockchain. Attempts by centralized entities to provide this service have largely ended in disaster – the Bitfinex hack in 2016, the QuadrigaCX bankrupcy in 2019, and more recently the collapse of FTX in 2022 are among a substantial list of institutions that attempted to capitalize on the demand for Bitcoin yield before falling to ruin. Despite the risks, this demand shows no signs of subsiding, and there seemed no resolution to this tension without an unending cycle of centralized providers. That is, until Babylon published their litepaper.

The first ever decentralized Bitcoin staking platform has just entered its third round of BTC deposits as it approaches its full mainnet functionality. In this article we’ll cover

- The structure of the Babylon protocol

- What risks Bitcoin stakers are taking

- How to participate in the coming round

Let’s dive in.

Blockchain Security

Blockchains are optimized for adversarial conditions, but they need to get their trustworthiness from somewhere. Bitcoin gets its security from Proof of Work (PoW): nodes all over the world, expending large amounts of electricity to show proof of a mathematical puzzle. Ethereum and most Cosmos blockchains, by contrast, get their security from the nodes’ locked capital called stake. In both cases, misbehaviour by the nodes is punishable – in Bitcoin by the wasted expenditure of expensive electricity, and in Proof of Stake (PoS) systems by the destruction (or slashing) of the stake.

Native PoS tokens have grown famous for their ability to earn yield. Particularly in the Cosmos ecosystem, where most chains use a Delegated Proof of Stake protocol, non-technical users can nominate operators to stake on their behalf in exchange for a small commission. But earning similar yield natively on Bitcoin is impossible – the PoW rewards only go to the mining nodes, not to holders. As a result, there is now ~ $2 trillion of idle Bitcoin capital.

But, what if this capital could be used as stake for securing smaller PoS chains, and in turn earn a portion of the rewards that protocols would otherwise pay out for their own native stake? To make this possible is Babylon’s core proposition.

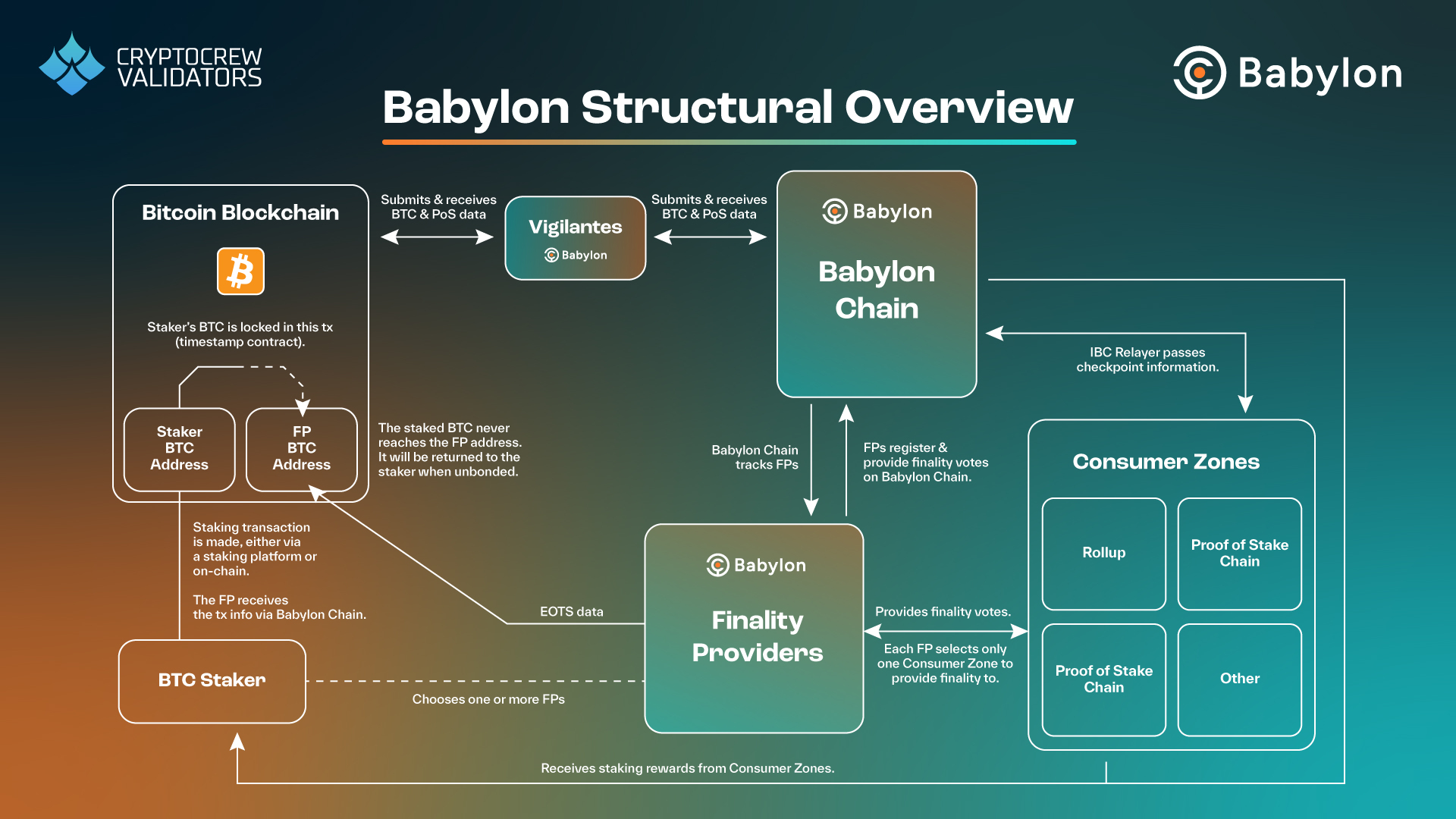

A Control Plane

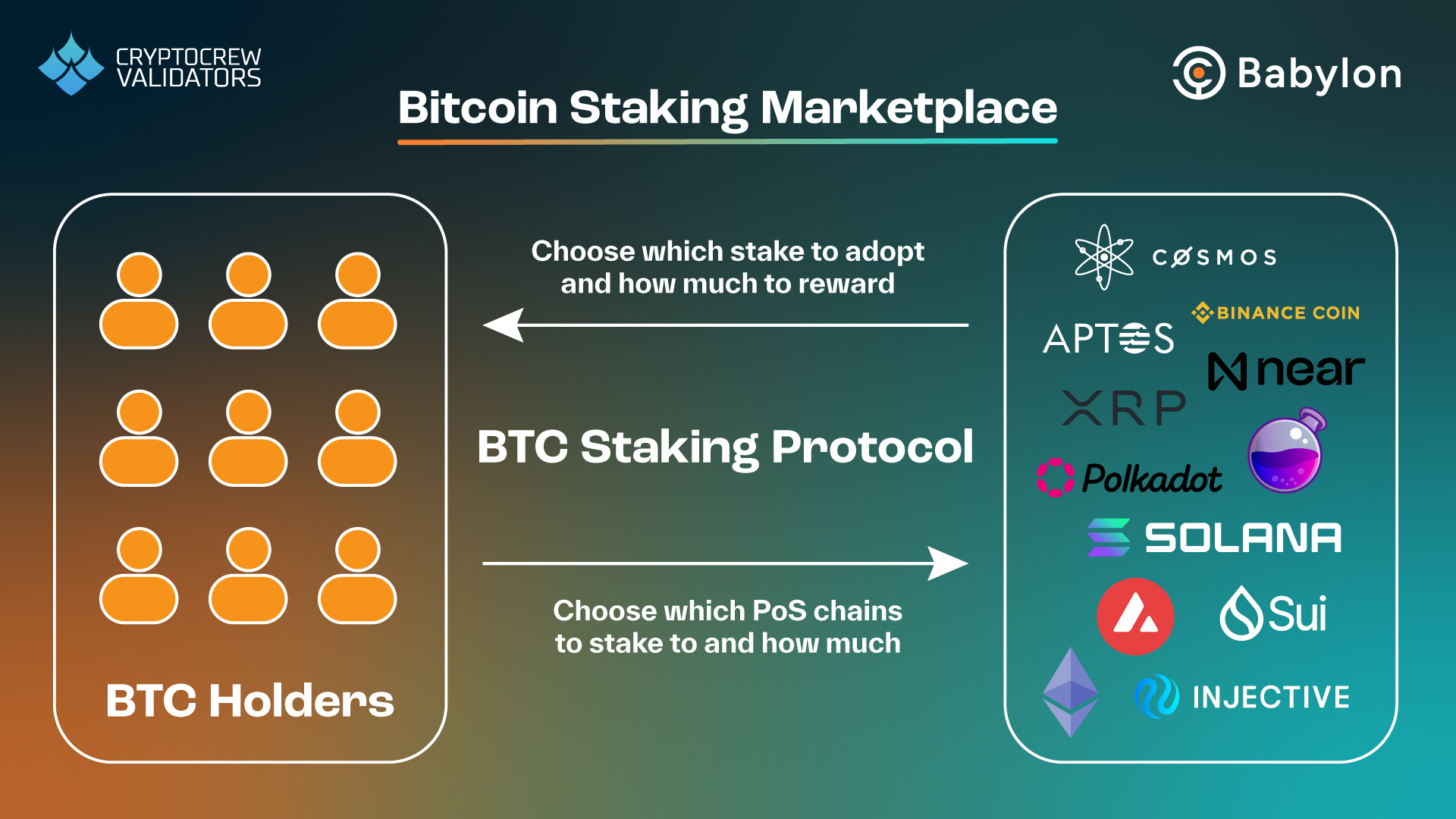

The best way to think about the Babylon protocol is as a control plane that sits between PoS chains that need staked capital for security, and the Bitcoin holders who wish to provide that capital. It is worth noting that rollups and other Layer 2 protocols can also receive security from Babylon, but for the remainder of the article we will focus on the PoS ecosystem.

Data about transactions needs to flow from the PoS chains into Babylon where it can be processed and matched with data about BTC staking from the Bitcoin chain. In this role, Babylon can provide services like:

- A marketplace, matching BTC stakers with PoS providers

- Tracking the PoS staking and validation information

- Timestamping for PoS states on the Bitcoin chain

Bitcoin Staking Marketplace

We will cover all of this in more detail. Let’s start with how Bitcoin staking works when no mistakes are made and no malicious activity occurs.

Part 1: Nothing Goes Wrong

Suppose you, a Bitcoin holder, wish to earn yield with Babylon by using your BTC as stake to secure smaller PoS chains. Two important points are worth emphasizing:

(1) The Bitcoin staking is non-custodial – No third party ever takes control of your BTC

(2) There is no bridging – No representation of your BTC is ever minted on any other blockchain

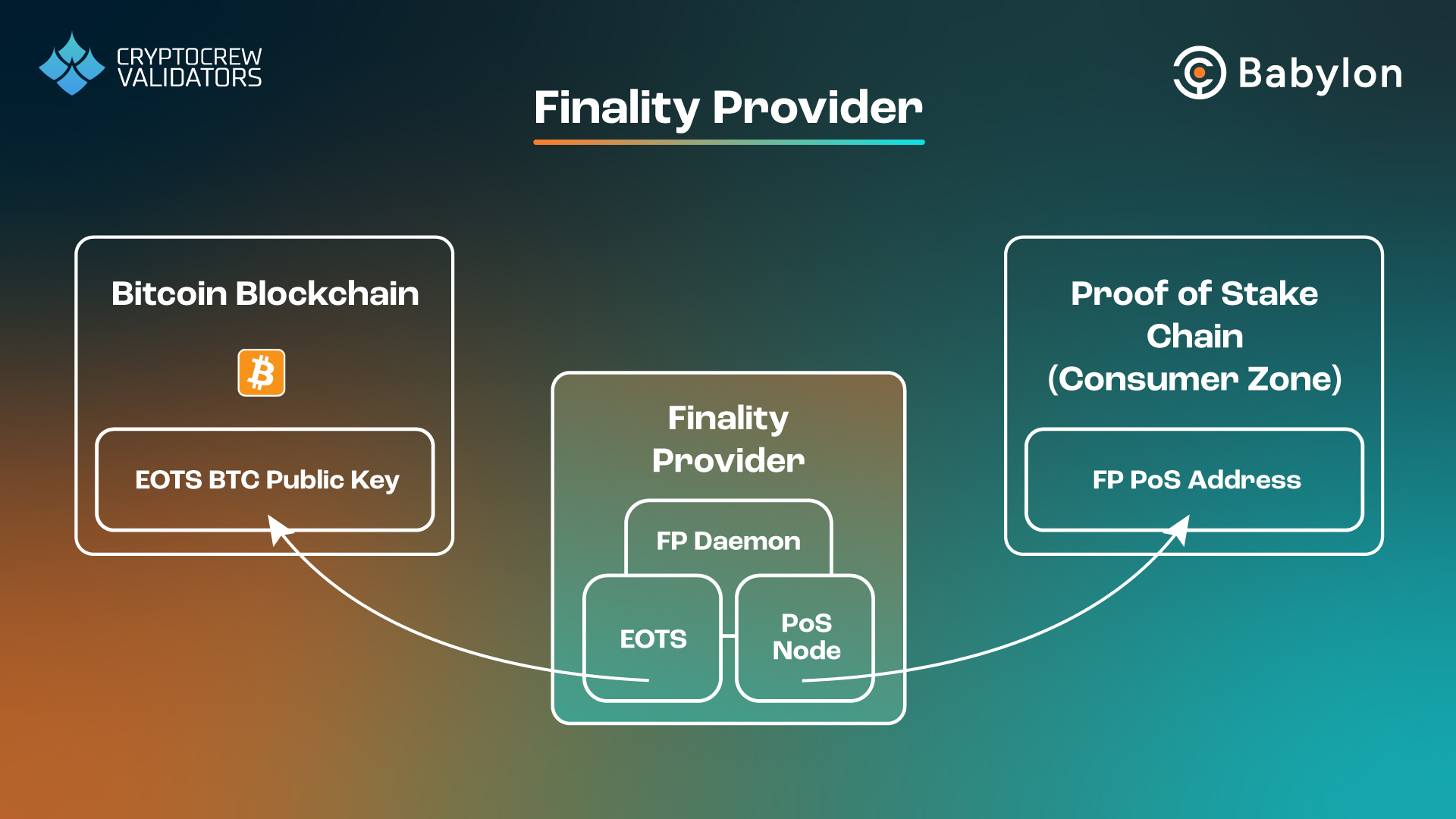

First off, you must select a finality provider (FP) that you can delegate your BTC to. This step is critical since mistakes by the FP could result in your BTC getting slashed. We will return to this slashing a bit later, but you can review the available finality providers for the Babylon chain here. An FP is a special kind of validator, and we will cover its functions in the next section. It has an address on the PoS chain where it participates in consensus AND a connected address on Bitcoin. While it is prudent to delegate across several FPs to mitigate risks, for the rest of our example I’ll use CryptoCrew as your chosen FP.

Finality Provider blockchain relationships

Next, you submit a Bitcoin staking transaction, and this must be directed to CryptoCrew (your chosen FP) through their special Bitcoin address. Under the hood, you are actually committing your BTC to a timelock transaction. This is similar to a very simple smart contract, made possible by Bitcoin’s library of opcodes. In the background, an independent set of computers running the *vigilante software* function a bit like relayers – they pass information about staking transactions between the Bitcoin blockchain and the Babylon blockchain and monitor for unbonding transactions.

And that’s it! Once everything is confirmed across both chains, your BTC is now staked, safe and sound with CryptoCrew, and you will begin accruing rewards for the PoS chain you have selected. At some point, when you are ready to unlock your BTC, you simply need to submit an unbonding transaction.

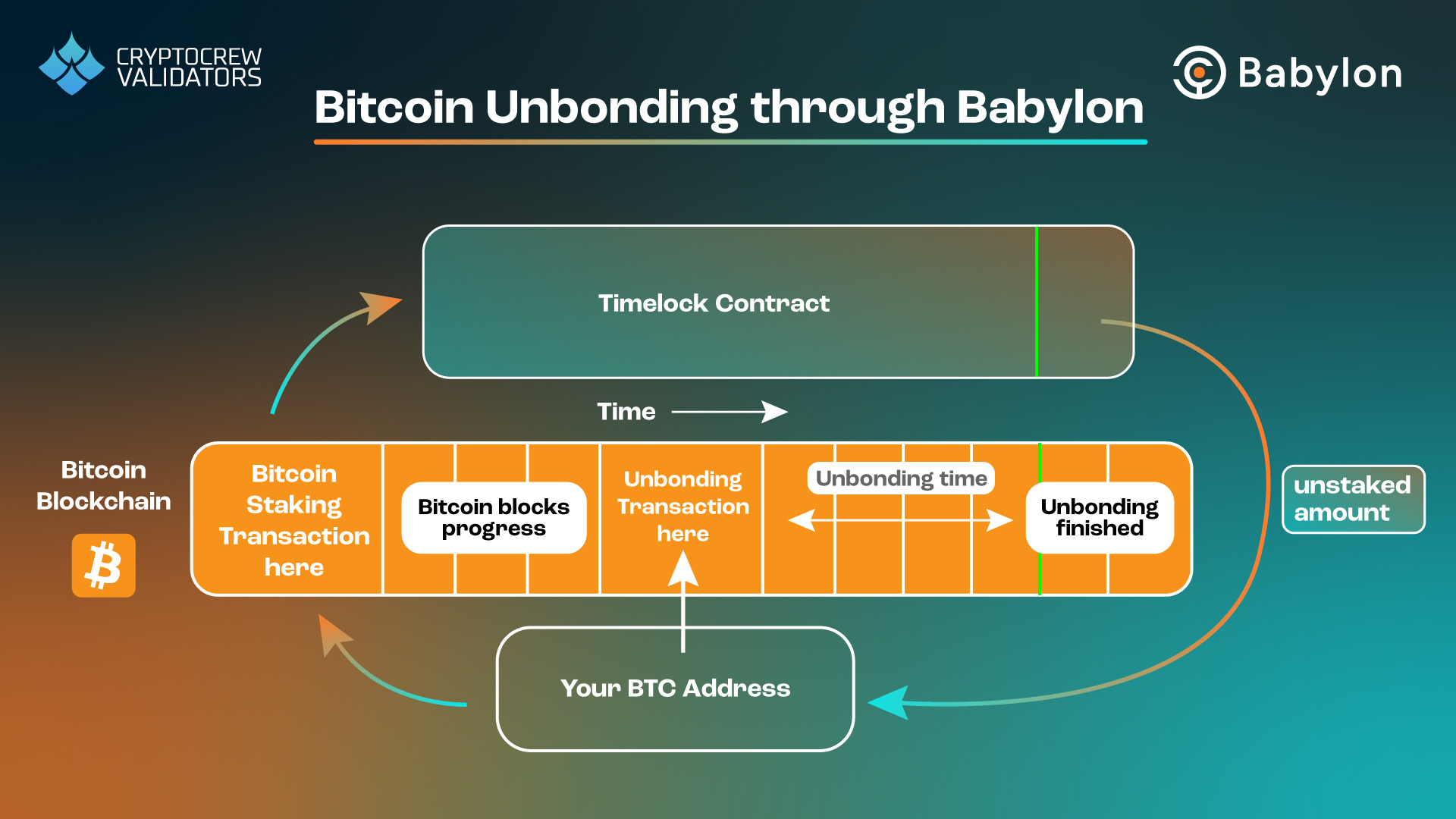

Babylon unbonding transactions

For those familiar with Cosmos chains, you are used to unbonding periods of several weeks, which can be quite frustrating. Because of Bitcoin’s greater long-term security, the unbonding time for your BTC can be much shorter! For the upcoming round, the unbonding period is set to only seven days, but the litepaper suggests that it could be as short as three days in the future. As an added bonus, PoS networks that utilize Babylon will have important data about their chain timestamped to the Bitcoin blockchain (by the same vigilantes that I mentioned above), dramatically increasing their security, and reducing their need for long unbonding times!

Sounds like everything is just peachy, right?

Part 2: Bad Actors

Bitcoin set the standard for digital assets designed to withstand adversarial conditions, and Bitcoin users have become used to the highest standards of security. Because the Babylon staking process is complex, it must have safeguards at all steps to ensure that malicious actors cannot harm individual users. Slashing is by far the most important, and it’s not obvious how such a process is even possible on Bitcoin, so let’s go through it.

Slashing in PoS Networks

Since the slashing mechanism in Babylon closely resembles the Cosmos native one, let’s do a quick review here. If you are already an expert on how slashing works in the Cosmos, feel free to skip ahead.

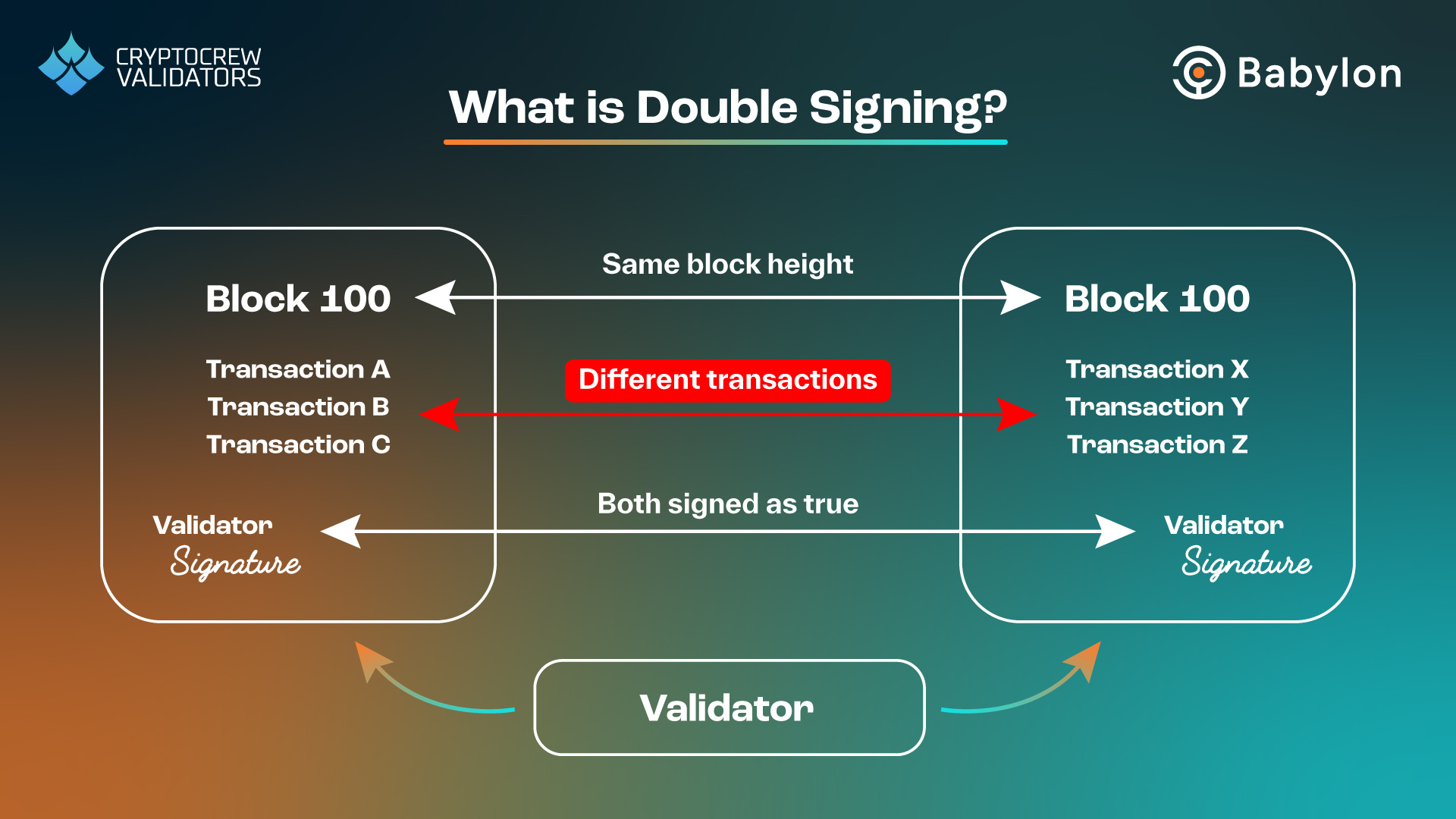

The worst sin that a validator can commit on a PoS chain to double-sign a block. This means that a validator is attesting to two different states at once, and such an attestation could cause a fork in the network. In PoS, a fork creates uncertainty about the ownership of assets on that chain and this instability is to be avoided at all costs.

Double-signing in Proof of Stake

Each Cosmos blockchain has a number of parameters that development teams can set according to their needs, and one of these is called the slash fraction doublesign parameter. This number determines what fraction of a validator’s stake will be destroyed in the event that a double-sign occurs, and on the Cosmos Hub for example, you can see that it is currently set to 5%. This means if you are delegating your ATOM to a validator who double-signs, your delegation will receive a 5% slash along with every other delegation to that validator. For Bitcoin staked with Babylon, this value will likely differ depending on which Babylon-enabled PoS chain the double-signing occurs.

Back to Babylon

The Bitcoin blockchain alone doesn’t have anywhere near the internal complexity to handle a sequence of events like the slashing mechanism described above, but through some very clever cryptography, Babylon have implemented such a system. The two technological pillars that make this possible are Extractable One-Time Signatures (EOTS) and Finality Gadgets.

Each FP participates in a special round of consensus using their EOTS signature. This extra round is referred to as a finality gadget, and occurs on top of the client chain’s native consensus (like CometBFT for Cosmos chains). The finality gadget creates the connection between activity on the PoS chain and the staked BTC on Bitcoin. While this is happening, Babylon nodes are checking in on the state of the PoS chain regularly using a normal IBC connection for checkpointing.

Here’s where it gets wild.

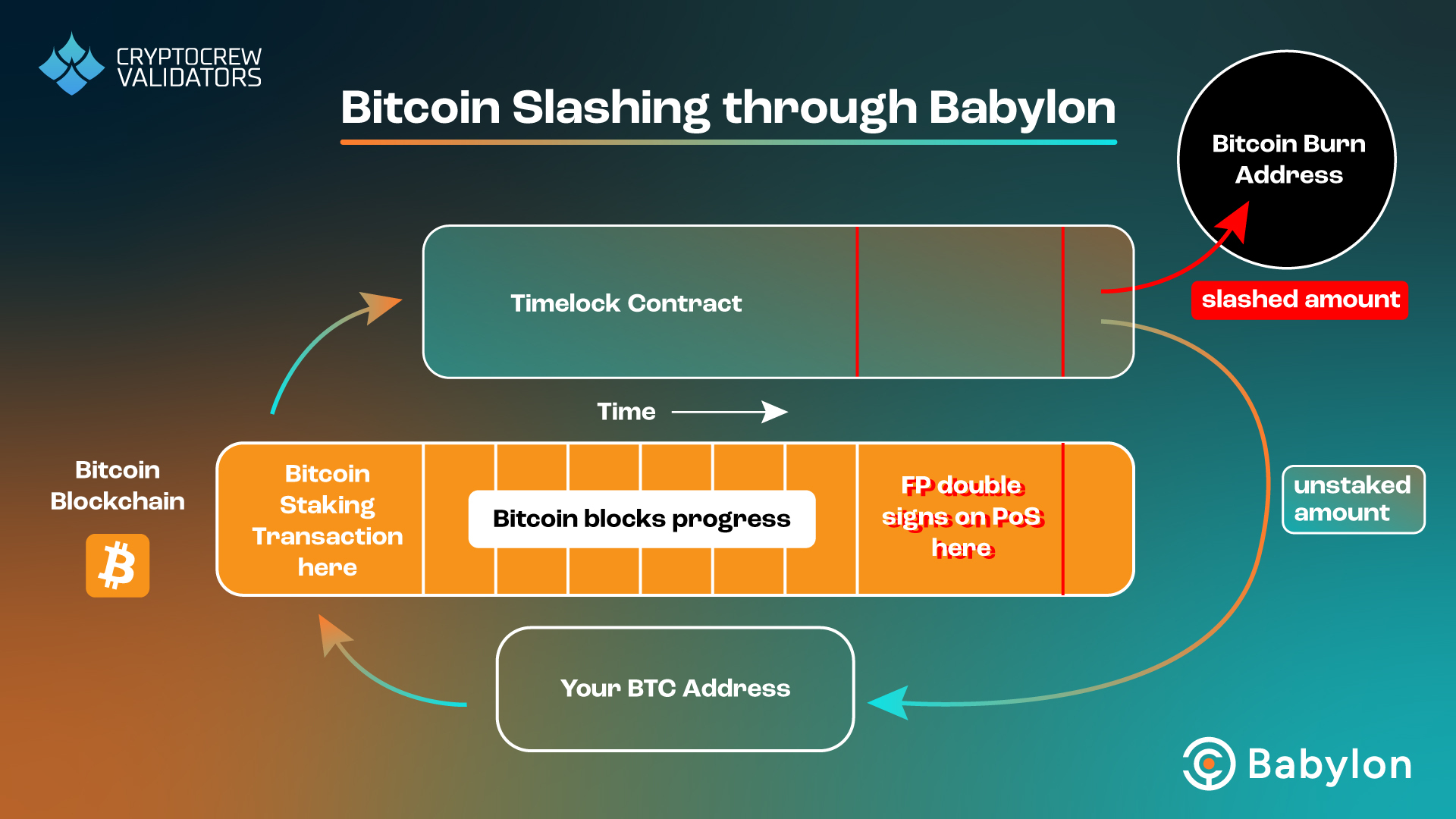

This EOTS signature guarantees that if an FP double-signs a block on the PoS chain, the private key for their corresponding Bitcoin address is revealed to the protocol. Once this occurs, the vigilante network can initiate a slashing transaction which will cascade across all the ‘delegated’ BTC timelock contracts. This will direct the slashable fraction of staked BTC to the Bitcoin burn address and the remainder to the addresses that originated the staking transactions.

Babylon slashing transactions

The bottom line: If your finality provider accidentally double signs on a Bitcoin-secured PoS chain, some fraction of YOUR staked Bitcoin will be destroyed. This is the risk you are taking as a ‘Bitcoin delegator’ in this protocol – entirely analogous to the risk you take as a staker on any Cosmos chain, but executed entirely on the Bitcoin blockchain. For more details, we recommend the litepaper and the technical paper. Remember, the tradeoff for taking on these risks is that your BTC is now earning permissionless yield for the first time ever!

Babylon Bitcoin staking architecture

Conclusion

It is important to note that despite the ambitious goals and innovative technologies present, Babylon is not fully live yet. Dozens of PoS networks have signaled interest for Bitcoin capital to secure their chains, but at the present time there are no rewards for stakers, and their mainnet should still be treated as in-development. In addition, other novel defi protocols like Lombard Finance and Lorenzo Protocol are already building on Babylon to create products like Bitcoin liquid staking tokens (LSTs) and more.

In the interest of safety, they have gradually been opening up the Bitcoin staking protocol to the public, and their third round of staking has recently begun. If you are interested in staking your BTC, here are the details for Babylon’s third cap of Phase-1 Bitcoin staking:

Start Date: Tuesday December 10th, 2024

Time: 11:00 am UTC

Duration: 1000 Bitcoin blocks (~ 7 days)

Each individual staking transaction has a minimum and a maximum limit:

Minimum Stake: 0.005 BTC

Maximum Stake: 5,000 BTC

Unlike in previous rounds, there are no caps: all valid Bitcoin transactions over the duration will be accepted, and any single address can create multiple valid staking transactions.

At CryptoCrew we are thrilled that a product like native Bitcoin yield, which has been so treacherous for so long, is on the threshold of being accessible to holders everywhere in a trust-minimized way. The Babylon team continues to be active in their research and we are confident in their ability to deliver a truly outstanding protocol. If you are so inclined, we are a finality provider on Babylon and would be grateful for your BTC delegations. We are here for the Bitcoin renaissance.

Thanks for reading!

~Robin Tunley