What it Means to be a Designated Proposer for dYdX

The dYdX chain recently underwent an upgrade to improve the performance and fairness of trading on their platform. As part of this upgrade, a small number of highly capable and reliable validators have been assigned as Designated Block Proposers, and we are delighted to announce that CryptoCrew has been nominated to be among the first eight validators to fulfill this responsibility. A combination of our ultra-high availability (UHA) infrastructure and our diligent attention to incident response has allowed us to be selected for this prestigious role. In this article we’ll walk you through some details about the new network architecture and about our top tier infrastructure.

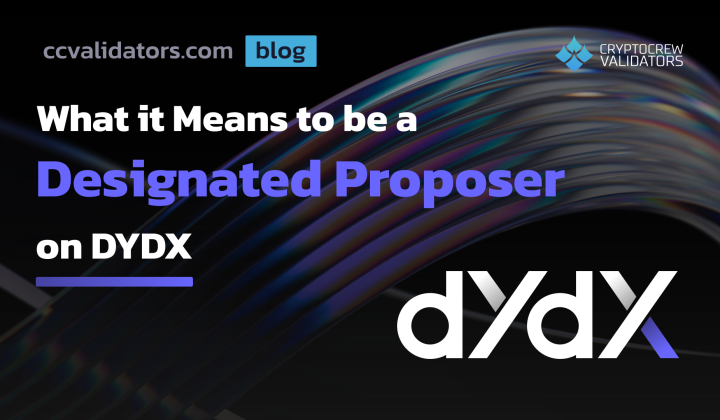

Previous Architecture

As a pioneer of onchain perps trading, and seeing an annualized revenue of $21 million (Defi Llama), dYdX moved to a Cosmos based chain to ensure that no level of their technology would hinder the quality of their exchange. The latest upgrade adds to this legacy by introducing two new features to significantly improve their previous order flow, which we will briefly review here.

When a user submits a transaction on a default Cosmos-SDK chain, it is sent by their wallet to an RPC node where it first enters the gossip layer. From there, it must pass through the network of all full nodes and validators until it arrives at the next block proposer. While this architecture is perfectly fine for transactions with long time horizons, lots of perp trading occurs on second or subsecond scales, and so small increases in latency can result in poorly executed trades.

To get around this, professional traders on dYdX preferred to run their own private full nodes. This provided them with two advantages in order submission:

(1) Their private full node could inject their order directly into the gossip layer, eliminating latency typically associated with public RPCs.

(2) These private full nodes were never burdened by orders from other users, unlike the ones being used by retail wallets, providing better performance particularly in periods of heightened activity.

dYdX previous architecture

The major takeaway is that the previous architecture incentivized a disparity between professional and retail traders that would have been difficult to anticipate at launch. This disparity inspired the dYdX team to propose a new network architecture – one that increases throughput, responsiveness, and fairness for all traders.

Order Entry Gateway Service (OGES)

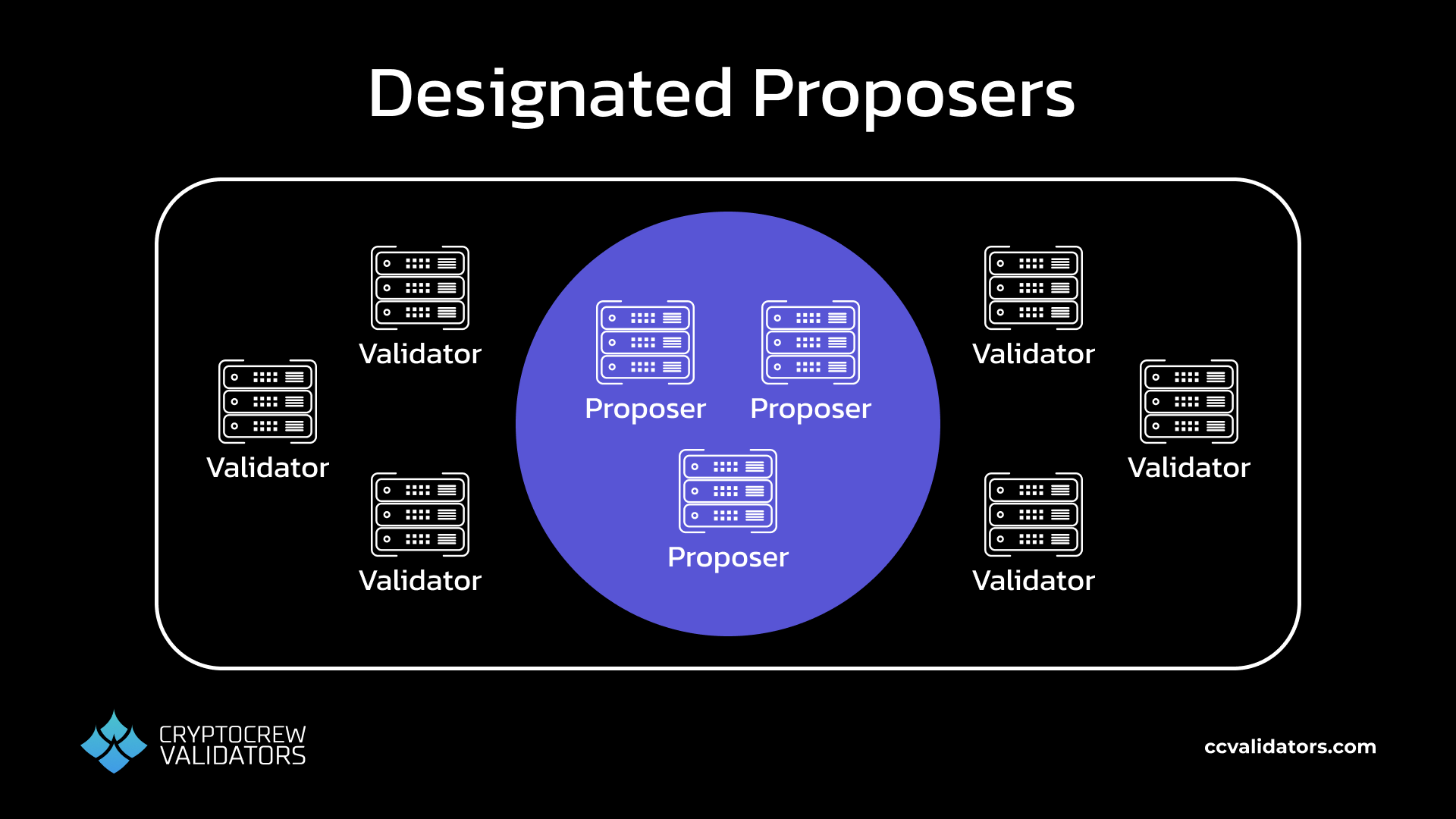

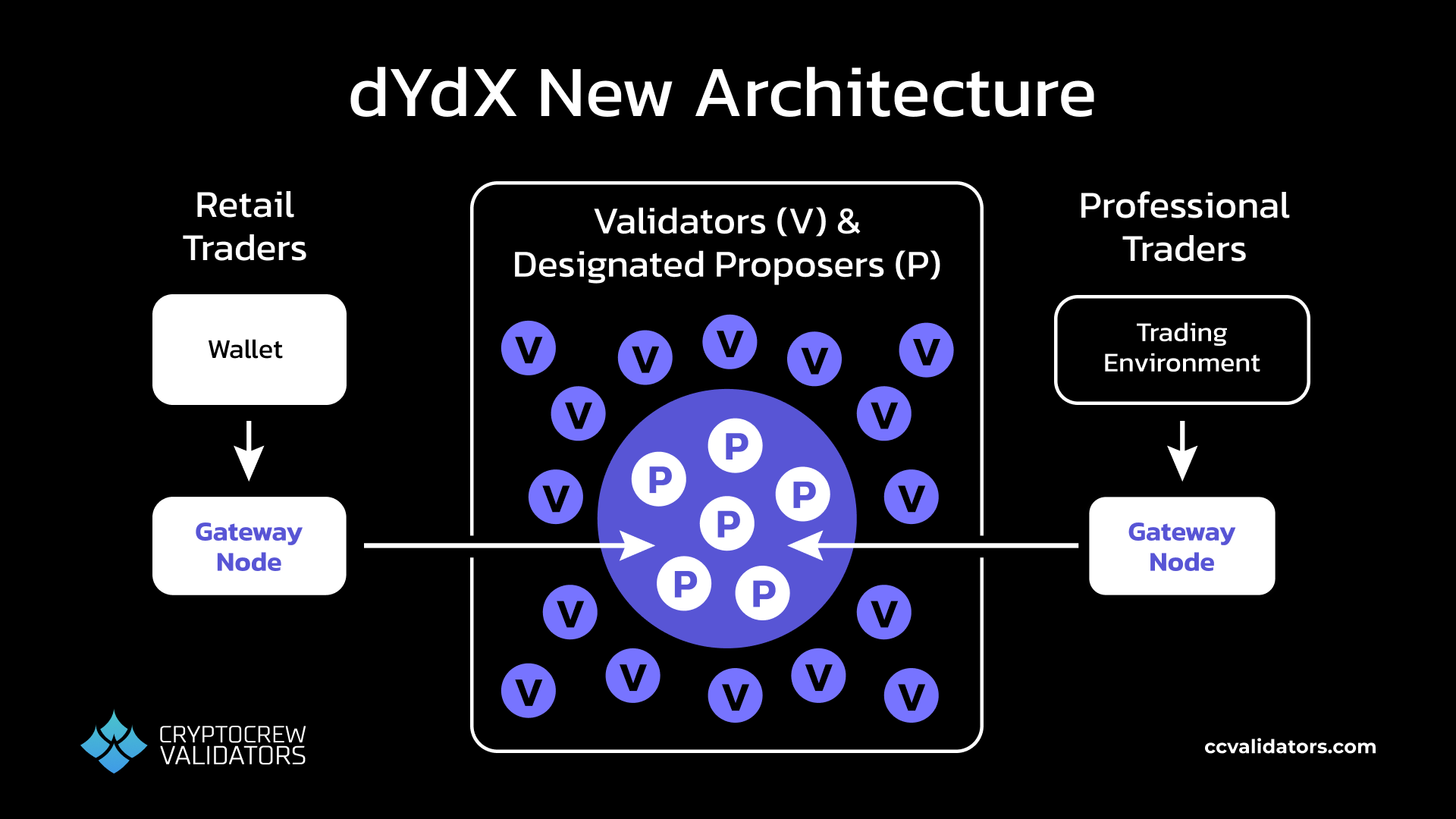

The OEGS has two primary components designed to resolve this tension. The first is the introduction of the Designated Proposer set. This is a subset of the current validators who alone are responsible for proposing blocks, while the remaining validators continue to be responsible for validating them.

CryptoCrew was chosen as one of 8 Designated Proposers of the first iteration, mostly due to our almost perfect uptime history on dYdX, and our diligent process of incident response. Our validator architecture is comprised of multiple redundant sentry nodes and remote MPC (multi-party computation) signers, ensuring highly secure and reliable uptime. We also facilitate low latency transaction processing due to our geographic proximity to other proposers and traders, and impose a strict NO-MEV policy on dYdX, contributing to enhanced fairness of order flows.

Designated Proposers are held to much higher standards in terms of performance than their peers, and the consequences of missed blocks, downtime, or being jailed are much higher: If any of the Designated Proposers fail their Service Level Agreements (SLAs), they can be removed from the Designated Proposer set by dYdX governance, and replaced by other validators who are better suited for the role. This has several major advantages:

- Fewer missed blocks lead to faster order processing

- Reduced block time leads to higher overall throughput

- Predictable peer relationships between nodes reduces the time orders spend in the gossip layer before reaching the proposer

- Reduced surface area for validator monitoring and quality control

dYdX designated proposers

Managing Designated Proposers through governance allows dYdX to achieve a balance between decentralization and performance. But even though Designated Proposers will improve throughput and order processing for all traders, another component is needed to reduce the discrepancy between professional and retail trades:

Enter Gateway Nodes.

These RPC nodes level the playing field for order processing by connecting directly to the Designated Proposer set. They are maintained by the dYdX Operations DAO and are available to everybody, accepting and broadcasting orders from both professional traders and retail in a single hop.

dYdX new architecture

Since the dYdX v9.0 and v9.1 upgrades, and the assignment of the initial Designated Proposer set, this new architecture is already at work improving throughput, latency, and fairness for all traders. It is worth noting, that this change does not affect onchain rewards in any way. Stakers delegating to Designated Proposers will continue receiving the same rewards after the upgrade is complete.

Conclusion

At CryptoCrew, we appreciate the continuous efforts of dYdX to improve the trading experience of the platform. We are excited that our validator (in collaboration with Defi Dojo) has met the strict requirements of the Designated Proposer set. We are committed to always provide dYdX users with the best possible trading experience and are ready to continue securing the frontier in perps trading.

- Stake your $DYDX with CryptoCrew here!

- Contact us for UHA & latency-optimized RPC infrastructure services for dYdX!

Written by Robin Tunley and Clemens Scarpatetti