Trillions On-Chain? How MANTRA Unlocks the Potential of Real World Assets

The launch of Bitcoin in 2009 caused the splitting of the global economy. On the one hand, it spawned a world of assets that exist only on blockchains, and has been expanding rapidly ever since. On the other, you had the set of all previously existing global assets which are tightly tied to their local geopolitical situation – this includes cash, stocks, bonds, property, commodities, and others. This realm of “Real World Assets” (RWAs) utterly dwarfs the blockchain economy, which is a substantial opportunity for any blockchain ecosystem capable of capturing some slice of it.

Enter MANTRA.

MANTRA are building a dedicated Cosmos blockchain to begin migrating some of this wealth on-chain through a process called asset tokenization. In this article we’ll cover

(1) What MANTRA is building

(2) Why it is important

(3) How it will work

Let’s dive in.

The Value of Real World Assets

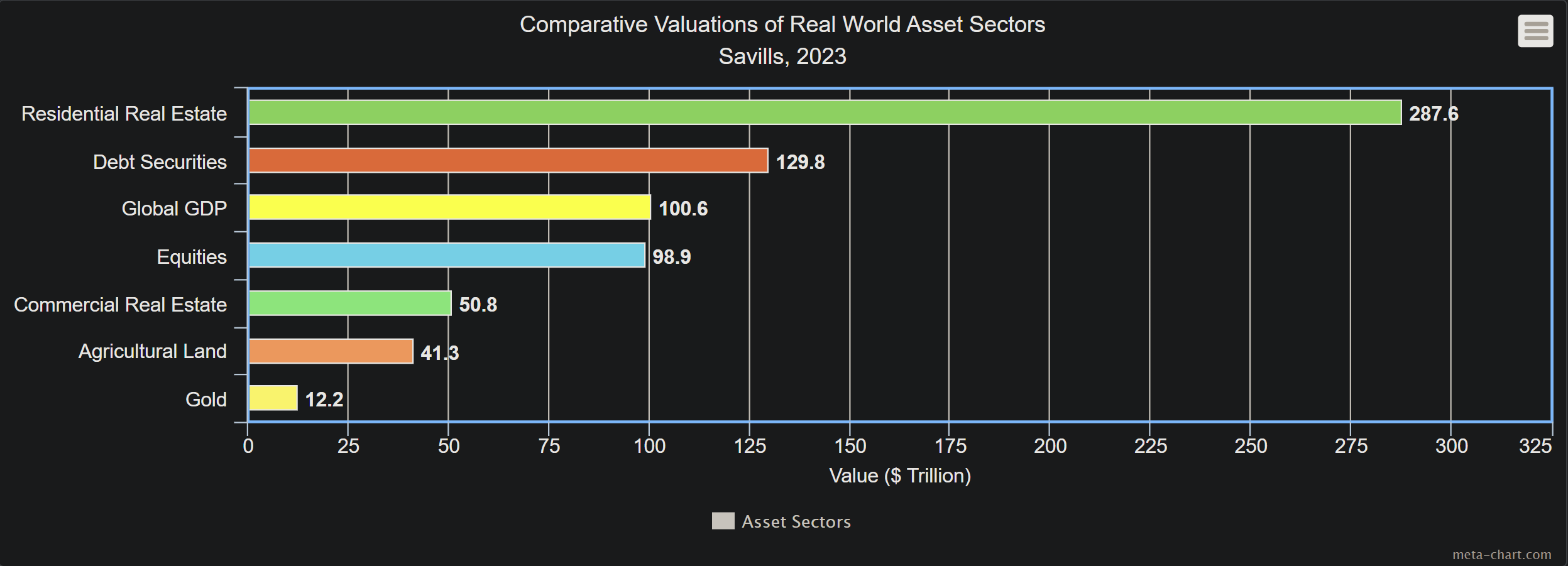

How large is the market of real world assets? It’s a difficult question to put a precise number on, but we can do some estimates using the Savills’ research from the end of 2022:

Valuations of Real World Asset Sectors

Not including Global GDP, this data puts the total value of real world assets at around $620 trillion, with property making up 60% at $380 trillion. Meanwhile, the total market capitalization of all cryptocurrencies combined sits at around $2.5 trillion. This puts the RWA market at around 248 times larger than the entire existing on-chain economy, with property alone being 152 times larger.

Needless to say, the successful capture of even a modest slice of these markets would be wildly lucrative, and this is where MANTRA has their sights set.

MANTRA Chain

There’s a serious problem with this whole idea though: blockchains by their very nature are global and permissionless, while RWAs tend to be local and require steps like Know-Your-Customer (or KYC) and other real-world identification procedures. For this very reason, MANTRA cannot build a complete solution on an existing platform like Ethereum – they need their own blockchain with custom features to handle compliance.

Since the Cosmos software developer kit (SDK) is the most flexible blockchain development suite in the market, this is the natural choice for such an ambitious endeavour. They announced their mainnet launch in late October 2024, which will inherit a variety of technological features from the Cosmos stack including:

- An on-chain governance system for continuous community-supported upgrades

- Interoperability with other Cosmos chains through the interblockchain communication protocol (or IBC)

- Delegated proof of stake (dPOS) through CometBFT – one of the most performant and battle-tested consensus protocols in existence

- CosmWasm smart contracts

All of these features are powerful, but none provide the functionality to begin migrating RWAs on-chain. This is done through tokenization – the representation of a real world asset by tokens on the MANTRA blockchain.

Why Tokenize?

In most places in the world, RWAs are supported by a host of laws and regulations which protect both buyers and sellers from malicious or negligent behaviour. By contrast, nations have progressed at very different rates merging and developing laws for on-chain assets, and so there continues to be a looming sense of regulatory concern in this area. Regardless, there are considerable advantages to being able to list an asset on a blockchain.

The first is transparency – blockchains are public, so ownership of a tokenized asset is never in question. The transparency of a public blockchain also enables for a complete history of ownership to be known by all parties involved as each sale will be recorded in the immutable ledger.

Automation of these transactions by on-chain smart contracts removes the need for brokers, escrow services, and other intermediaries which are typically required to reduce counter-party risks. This dramatically improves the cost-effectiveness and efficiency of transactions, which in turn can lead to more efficient pricing of these assets.

Finally, while many people may be unable to invest in an entire apartment building or beach resort, tokenization of these sorts of assets allows for a broader spectrum of investors (and their liquidity) to access opportunities. Combine this with the global and borderless nature of blockchains, and the doors have opened for an enormous new range of market participants.

Ok, so tokenization might be powerful, but how does it actually happen?

This process is going to look different for different asset types and in different regions with different regulations, so there’s no one-size-fits-all answer for this important question. To get a broad sense of the process, let’s look at a specific example.

Tokenization Example

Since MANTRA are looking to focus on the property market first, it is sensible to start here. Let’s suppose you are a real estate development firm, and you have decided that you want to tokenize one of your lovely beachside villas.

Beach-side Villa by Venice.ai

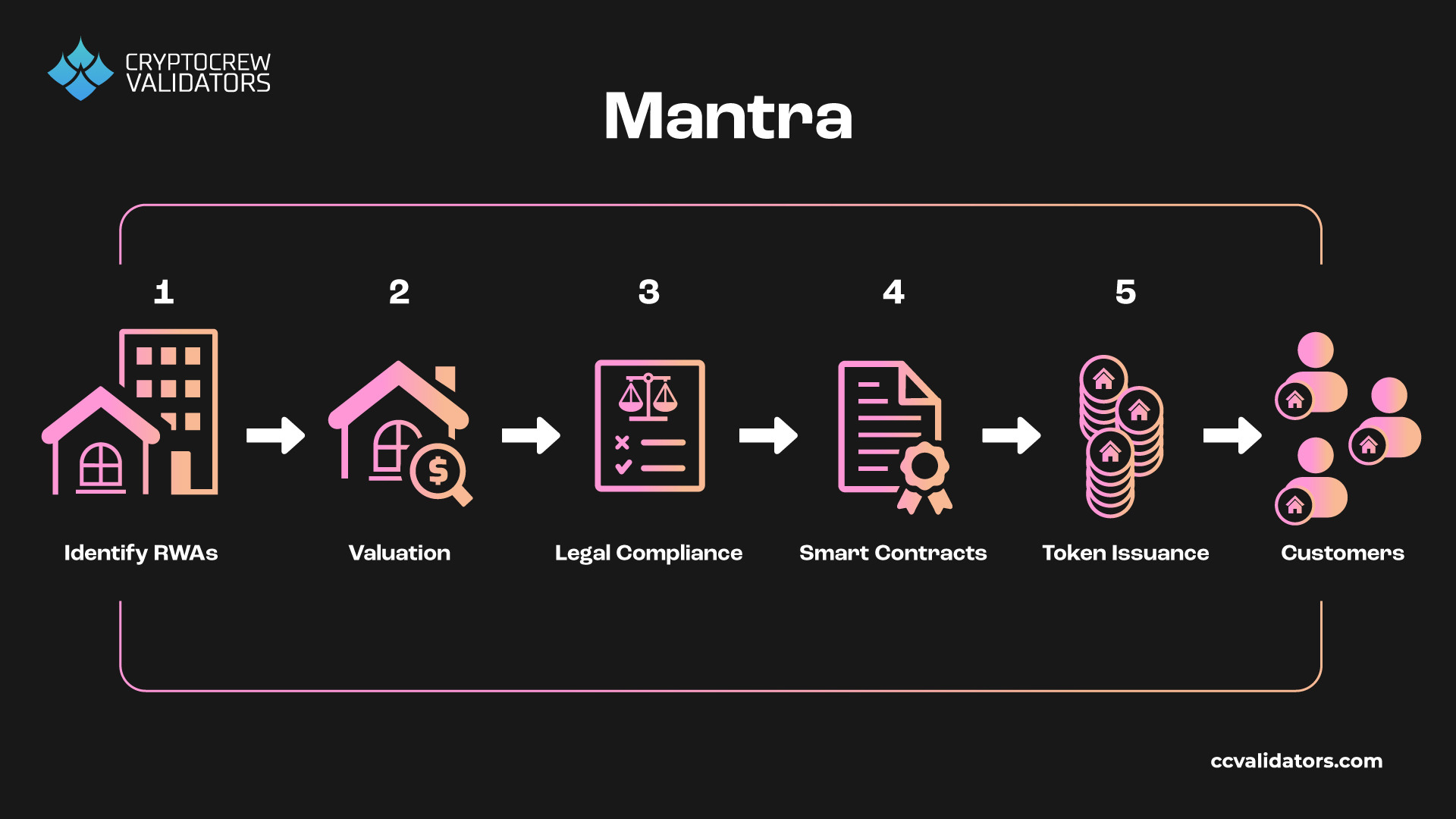

In their academy, MANTRA have laid out a playbook for how this could happen, so let’s walk through it for our example.

Step 1: Identification

This step is critical. It not only encompasses what you want to tokenize (in our case, our villa), but also what ownership of such a token actually means. If I am a token holder, what am I entitled to?

For our example, let’s break the ownership of this villa into 100 tokens, and each token will entitle the owner to 1/100 of the revenue earned by renting it out. As the development agency, we might decide to keep some fraction of these tokens for ourselves, but perhaps we can sell the remainder to raise funds for a future venture.

There’s nothing special about the number ‘100’ here either. We could just as easily tokenize the villa as a single token that can be fractionalized – broken into smaller pieces – but 100 tokenized ‘shares’ of a villa is probably easier to imagine, so lets roll with that.

Step 2: Valuation

This is one of the steps that is highly dependent on regional regulations: we need to know what price we can or should tell these tokens for. For our villa, we could hire a professional real estate firm (or several) to provide a valuation of the property. Eventually, these valuations could be posted on-chain for all participants to witness before deciding whether they want to purchase the token or not.

Another possible path is for the tokens to be auctioned off, allowing potential buyers to gauge the interest of other participants more gradually and bid what they feel is fair. As MANTRA begin working with their clients and customers, they can build out automated processes for the valuation procedures that are required both by law, and by their users.

Step 3: Legal Compliance

This is not a strict step in it’s own right – legal compliance must be adhered to in all steps of the tokenization process. One of the most important compliance procedures will be the KYC procedures. In most countries you are not allowed to purchase a home, stocks, or bonds without some issuing authority knowing your identity.

MANTRA will introduce it’s Guard Module to handle these kinds of processes. Think of it like a puzzle piece that can fit cleanly into the existing modules of the Cosmos blockchain stack. Its job will be to allow MANTRA app users to complete local KYC requirements so that they may participate in the token markets that require this, and it does this using a cool technology called soulbound NFTs. I won’t dive into the weeds of this here, but for more details you can check out this academy post.

Once we have an pool of compliant users, there there are some interesting questions we can ask about our example:

- Are we allowed to tokenize this property?

- Does the law recognize the tokens as entitling the owner to payouts?

- Are you even allowed to distribute revenue in this fashion?

If the answer to any of these sorts of questions is ‘no’, or if there is no clear legal precedent for this kind of venture, this villa may need to be monetized the old fashioned way. However, there are jurisdictions that are progressing towards regulatory clarity for situations like this (for example, Hong Kong, Singapore, and Dubai) and these are areas where the MANTRA team will focus their initial efforts.

Step 4: Smart Contract Creation

To launch our villa-tokens we will need two smart contracts.

The first is the actual token-creation contract. We will need to submit a variety of parameters that will define how our tokens get minted: We want 100, we want them to be fungible (as opposed to non-fungible), and so on. This contract will exist on the MANTRA chain and can be utilized by us as soon as we complete our own KYC process.

Next, we will likely require a smart contract that can distribute the revenue in correct amounts to token holders. Such a contract would be slightly more specialized, but reasonably simple:

(1) Determine the revenue from the villa

(2) Determine all addresses that hold the villa-tokens

(3) Calculate the fraction owed to each address

(4) Distribute the correct amount to each address

There are already many examples of contracts which perform similar functions in production today. Since many investors are seeking passive cashflow from their investments, it’s reasonable to assume that generalized contracts like this will come to exist on MANTRA .

In general, the smart contracts that people need to monetize their assets the way they want will need to be built by app developers who want access to MANTRA audience of KYC-ed customers – not by us, the property developers.

Step 5: Token Issuance

Finally, once all the groundwork is done, our tokens can be minted on the MANTRA blockchain! Once minted, these tokens can be sent to investors who purchased them, or put up in an auction-style smart contract to be purchased, or listed in an exchange. Most importantly, any or all of these options can be made available to a set of compliant customers from around the world.

Asset tokenization steps

Conclusion

You made it! Hopefully you now understand that

- MANTRA is a dedicated blockchain for the tokenization and monetization of real world assets (RWAs)

- The RWA market is massive compared to the current on-chain economy

- Assets on MANTRA can be bought, sold, and traded globally while adhering to full compliance with their local jurisdictions

At CryptoCrew we are excited at the prospect of real world assets moving on chain into a more trustless, open, and verifiable environment and we applaud MANTRA’s efforts to push this dream forward. We are thrilled to be one of their genesis validators, and look forward to supporting their mission as it extends beyond the Cosmos. In this article, we’ve only scratched the surface of this exciting new frontier, but we hope you’ll consider staking your MANTRA tokens with us as we go along for the ride.

Thanks for reading!

~Robin Tunley