Injective and the RWA Revolution

In his most recent annual chairman’s letter, Larry Fink – CEO of Blackrock – boldly declared that “Tokenization is democratization” and that “Every stock, every bond, every fund – every asset – can be tokenized. If they are, it will revolutionize investing”. But if you haven’t been keeping your fingers on the pulse of the blockchain world, these words may be more confusing than inspiring. What is tokenization and how can it democratize anything? We can borrow the definition from the 2024 Deloitte report on tokenization:

“[Tokenization is] the linking of financial assets to digital tokens traded on distributed ledgers, including blockchains, whereby the tokens reflect the fair value of the underlying assets.”

With giants like Blackrock and Deloitte taking notice, the race to be the earliest protocols successfully tokenizing Real World Assets (RWAs) has never been more feverish and Injective – a Layer 1 blockchain customized for financial applications – is taking giant strides. In this article, we will

(1) Introduce tokenization, including its benefits and challenges

(2) Give an overview of the Injective blockchain and how it supports RWAs

(3) Look at some specific examples of RWAs being traded on Injective right now

Let’s dive in.

An Overview of Injective

Injective is a blockchain purpose-built for finance, designed to provide the infrastructure and tooling needed for building next-generation DeFi applications, all powered by its native token, INJ.

Several core innovations distinguish Injective from other chains. It incorporates chain-level performance optimizations and a custom consensus mechanism to achieve sub-second block times (0.64 seconds!) and ultra-low fees ($0.0003 per transaction!), enabling the high-speed, low-latency environment required for financial applications. Injective also supports a robust multi-virtual machine environment, allowing developers to build natively with either CosmWasm or the Ethereum Virtual Machine (EVM). This flexibility enhances cross-ecosystem interoperability and widens the design space for developers.

At the protocol level, Injective offers a built-in Exchange Module that acts as an onchain central limit order book (CLOB). Any application built on Injective can plug into this module, enabling shared liquidity and advanced order types out of the box. Beyond the Exchange Module, Injective’s composable infrastructure supports a wide range of financial primitives via blockchain modules, from oracles and bridging to lending and tokenization. The plug-and-play nature of Injective’s modules allows developers to instantly integrate advanced financial logic into their apps without needing to build core infrastructure from scratch.

The network also includes a revenue-based burn mechanism known as the Community Burn. In this model, users commit INJ in exchange for a share of application-generated revenue collected across the ecosystem, with the committed INJ permanently removed from circulation. The Community Burn is one of its kind, aligning token supply dynamics with ecosystem growth, creating a deflationary mechanism that horizontally scales with the size and success of its onchain economy in a sustainable manner.

Several applications already showcase Injective’s capabilities. Helix provides onchain spot and derivatives trading using the CLOB model (via the Exchange Module), while the newly launched Choice Exchange offers an automated market maker (AMM) style trading experience. Both are built natively on Injective and benefit from its high performance and shared infrastructure.

More recently, the team has begun leveraging the specialized functionality of the chain for the tokenization and deployment of RWAs, which can include

- Real Estate

- Commodities

- National Currencies

- Stocks

- Bonds

- Institutional Funds

- Structured Products

- Works of Art

And more. Since we covered the tokenization of real estate extensively in our article on Mantra Chain, and the Injective team are focused more on equities and bonds, let’s look at how to tokenize a stock – Apple for example – on Injective.

The Real World Asset Landscape

Injective iAssets

Earlier attempts at synthetic assets typically involved some collateralized debt position (CDP) where the user would deposit excess collateral (often ~150% the value of the desired assets) in order to mint their synthetic asset. For example, If I wanted $100 worth of Apple stock, I would need to lock up $150 worth of ETH as collateral. This presents several issues, but the first and foremost is that my $50 buffer is not being utilized efficiently. Additionally, should the price of ETH suddenly drop, I may lose my collateral entirely in a liquidation event.

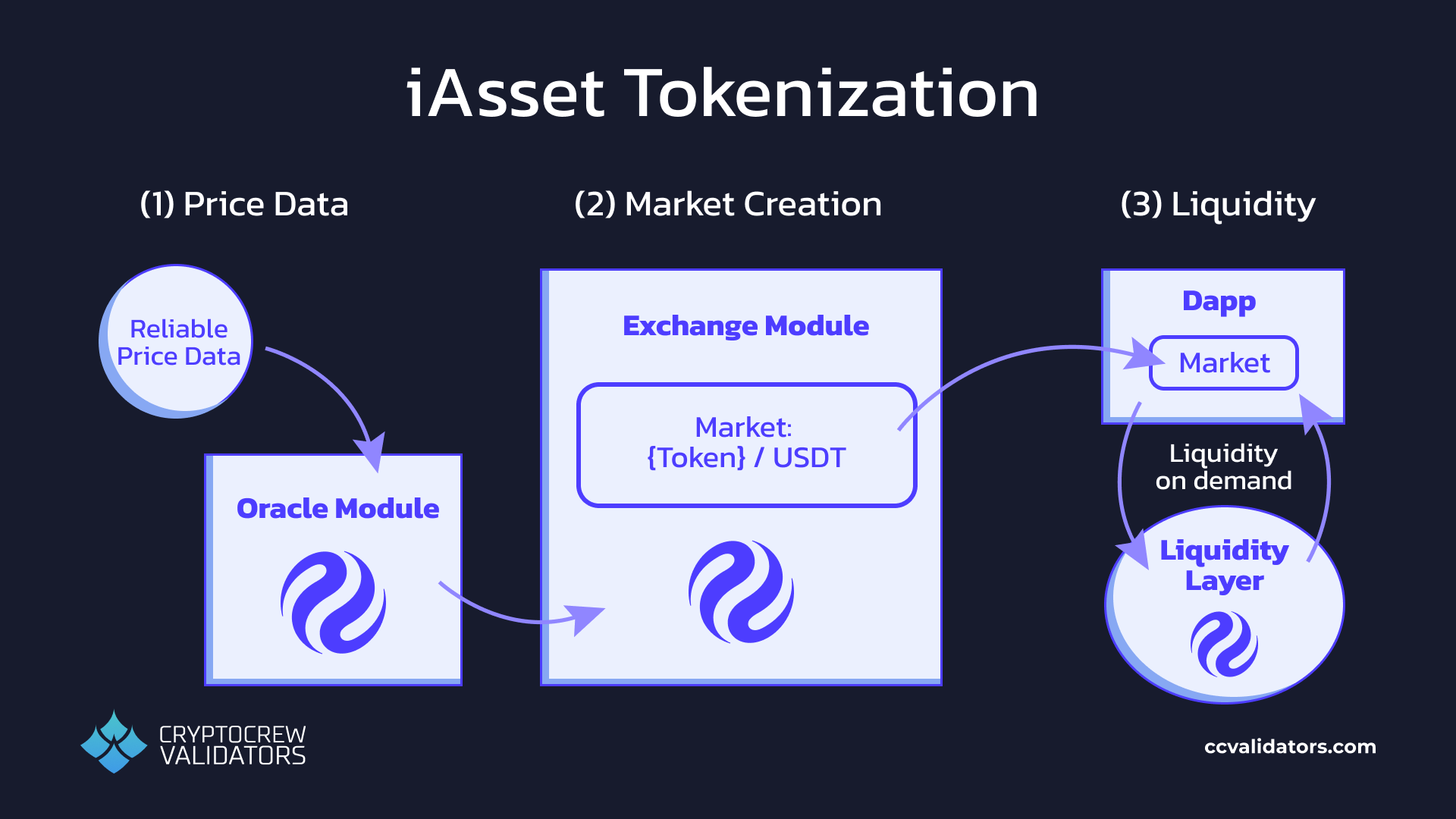

To bypass these issues, Injective has implemented the iAsset framework, where real-world assets can be created without collateralization and thus without its inherent inefficiencies and risks. For now, iAssets are perpetual futures contracts that track the price of an underlying asset and the issuance of a new iAsset involves three steps:

(1) Accurate price data through oracles

(2) Selection of a counter-asset through market creation

(3) Liquidity management and market-making

In the example of Apple stock, our first ingredient is for a reliable source of price data for AAPL to be incorporated in Injective’s oracle module. Next, someone must come along and create a market through the Exchange Module, using any counter asset. Since stablecoins are the most common for price stability, let’s assume our iAPPL market will be created against USDT. The creation of this market is completely permissionless. Finally, our new market requires liquidity – funding to ensure that too much buying or selling of the iAPPL token does not push its price away from the true price of AAPL.

iAsset tokenization

In previous incarnations of synthetic assets, users would provide liquidity to a single pool associated with our iAPPL/USDT market and all other pools for other assets would need to compete for this liquidity. iAssets bypass the zero-sum nature of liquidity within (and across) applications by leveraging the Exchange Module, which is powered by a decentralized network of professional, trusted financial firms that provide sophisticated liquidity provisioning services.

Any application built on this module can then access a shared liquidity layer, where liquidity can be deployed dynamically as required across applications and redirected in response to market conditions. By combining this structure with convenient tools for market makers, the shared liquidity layer ensures the trading of our iAPPL token receives the necessary liquidity for price stability. In the future, the Injective team is considering an extension of this architecture through a liquidity availability layer whereby liquidity would be accessible and dynamically deployed as needed across any application in the Injective ecosystem, not just those built on the Exchange module. For the time being however, this is still an ongoing area of research.

Ok, so our chosen stock is now tokenized… why did we bother?

Advantages of Tokenization

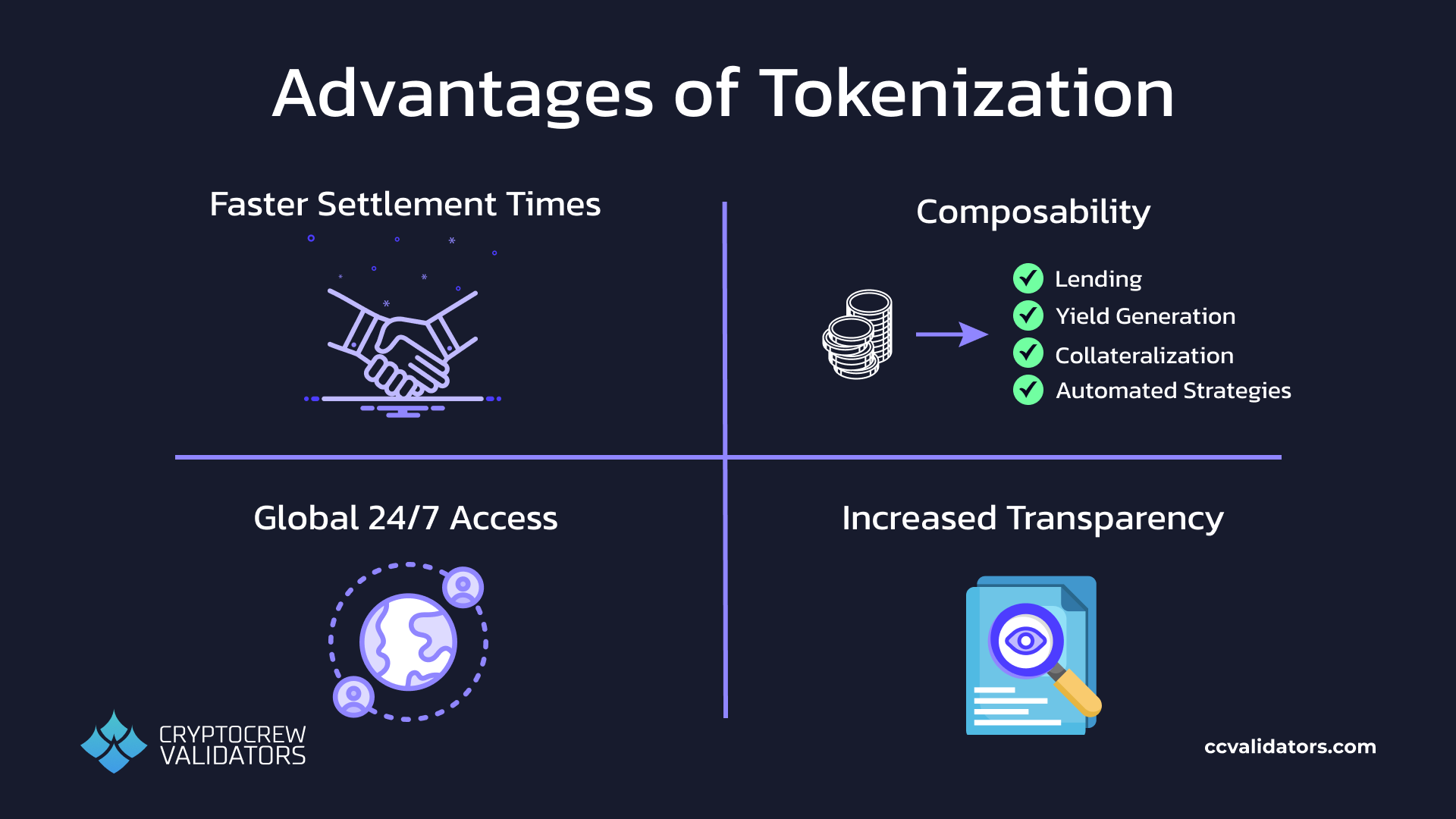

The biggest advantage of using a public blockchain as infrastructure for finance is that it automates critical aspects of a transaction that historically have been extremely manual. This automation comes with all sorts of benefits including

Faster settlement times – the global financial infrastructure is remarkably slow, and even the slowest blockchains like Bitcoin can wildly outperform most multi-bank hops. Considering that even the fastest international transfers will take a minimum of one business day, compared to Injective’s block time of ~0.64 seconds and instant finality, the chasm becomes laughably wide.

24/7 Global Access – since blockchains have automated the settlement component of a transaction, trading of these assets can occur at any time of day, in any part of the world where there is internet access. No more waiting for markets to open. Additionally, the creation of blockchain accounts is typically permissionless, removing the barriers created by traditional institutions as gatekeepers to financial services and activity. Anyone from anywhere on the planet can now buy and sell our iAPPL token, not just those born in the United States.

Increased transparency – Injective accounts and smart contracts can be audited in real time (unlike most counter parties in legacy finance) making it much easier to measure and manage risks.

Composability – since iAssets are a primitive on the Injective chain, they can easily be used as collateral for loans, in algorithmic trading strategies, for hedging, or for generating yields. Finding similar opportunities for the underlying physical assets is often difficult (or impossible) and may come with additional risks that are not easily managed.

Advantages of tokenizing real world assets

Despite these immense advantages, there are considerable challenges as well, many of which are outlined nicely in the Deloitte 2024 Tokenization Report. These can vary depending on the type of asset being tokenized, but here are some broad examples.

Challenges for Tokenization

Legacy backends – Institutions need to manually upgrade their infrastructure to incorporate blockchain technology. As many of these systems (like SWIFT for example) are rather antiquated, these upgrades can pose significant upfront and ongoing costs.

Regulatory clarity – Blockchain technology is still young and the laws around their use, particularly with respect to tokenization, are still very much in development. This includes laws around taxation, accounting, risk management, and beyond. The absence of clear regulations in many countries can make the tokenization of assets difficult.

Novel risks – smart contract vulnerabilities, key management, and economic attacks are just some examples of new considerations that individuals and institutions must plan for when utilizing blockchain technology to manage assets.

Despite these challenges, Injective has already made substantial progress on a number of RWA tokenization fronts.

A Taste of RWAs on Injective

In January 2024, Injective completed the Volan upgrade, which among other improvements brought the RWA module into full functionality. This module allows institutions to launch permissioned assets on Injective, facilitating their need for KYC/AML and other regulatory compliance. Since then, there have been many successful launches on the Injective chain.

Stablecoins

Stablecoins generally refer to tokens that represent a national currency, and by far the most common is the US dollar. Supported by the RWA module, Agora deployed their stablecoin AUSD on Injective, fully collateralized by assets managed by Van Eck and custodied by StateStreet. Stablecoins are a potent use case for blockchain technologies, and Injective-native markets benefit greatly from the liquidity and trust that AUSD brings. Ondo Finance also deployed their yield-bearing stablecoin USDY on Injective, giving users access to the yields generated by a basket of treasuries directly onchain. As of June 2025, USDY was backed by over $680 million in treasuries. The USDC stablecoin from Circle is also available on Injective via the Noble IBC-enabled blockchain. Circle also publishes monthly transparency reports on the backing of USDC.

Stocks & Funds

The iAsset framework has allowed over 25 synthetic stocks to be listed on the Injective chain. For those who wish to steer away from trying to pick winners, the TradFi index fund was launched as a way for users to get access to over 500 different US stocks in a single token, bringing the ease of index investing onchain. Other funds are possible as well: A tokenized version of Blackrock’s BUIDL fund is also live on Injective, giving users instant access to institutional yields.

Commodities

Injective is beginning experiments with tokenized commodities as well, beginning with gold and silver and recently adding crude oil. Given that the global commodities market sits at around $140 trillion, the gradual migration of these assets onchain will open up opportunities for people to participate in markets that they may otherwise have been excluded from. In the future, the team plans to expand their offerings to include other precious metals, more energy commodities, agricultural products, and more.

Conclusion

There’s no denying it – the flexibility offered by the Injective technology stack makes it one of the most competitive landscapes for building RWA applications onchain. Injective is in the process of leveraging this to make their L1 the best it can be, and at CryptoCrew we are thrilled to be on the front line. As more and more asset classes are democratized through tokenization, we want to be front and center validating and offering our support to the most important infrastructure, and Injective’s current positioning in the RWA game should not be underestimated.

Thanks for reading!

~ Robin